Tesla kicked out of S&P’s ESG Index: What just happened

Back to insights

Diana Rose, Head of ESG Research

14 June 2022

Outrage, surprise, confusion. But could we have seen this coming? We take a look at Tesla’s disclosure data to cut to the evidence.

What just happened?

On the 2 May, the S&P 500 dropped electric vehicle maker Tesla from its ESG Index as part of an annual update to the list. The S&P ESG index is one of a few household names, popular with investors building ESG funds and basing their investment decisions upon.

Tesla was “ineligible for index inclusion” in its fourth rebalance of the index, which uses environmental, social and governance data to score companies. Scores are based on hundreds of data points and aggregated up to a total score, which is then ranked against its industry group peers.

This last point is key. S&P explained that “while Tesla’s S&P DJI ESG Score has remained fairly stable year-over-year, it was pushed further down the ranks relative to its global industry group peers.”

Does it matter?

It seems to matter to Tesla’s CEO Elon Musk, who took to Twitter to vent his outrage in customary outspoken style, a bit like someone who’s just been dumped.

It matters to onlookers, baffled by the apparent paradox given Tesla’s stated mission is to accelerate the world’s transition to sustainable energy, while oil and gas companies still feature in the index.

It will also matter to some investors holding stocks in Tesla as part of their ESG funds, particularly if their investment strategy relies on S&P’s ratings. It may matter less to those who use more independent means and their own discretion to assess the ESG profiles of businesses. Either way, Tesla’s stock price went down by 6% immediately afterwards.

Should we be surprised?

No, not necessarily – we’ll come onto that. But it seems a lot of people were.

It has opened up fresh, healthy, debate over the ‘sausage-making’ machine of ratings agencies. Musk fumed that S&P has ‘lost their integrity’, while the ratings provider came out with a blog to clearly explain the basis of their decision.

The case was to many a surprise and to others a reminder that ESG is fundamentally about how a company manages its environmental and social risks, not necessarily about the impact it has on people and planet.

There’s a perception gap here which needs some attention and I expect will need to be cleaned up as part of the looming crackdown on greenwashing.

So what did Tesla do wrong?

In a nutshell, S&P explained that “while Tesla may be playing its part in taking fuel-powered cars off the road, it has fallen behind its peers when examined through a wider ESG lens”.

There are a few areas where it got a black mark – in summary; a lack of a low-carbon strategy, fines relating to emissions and waste, racism and poor working conditions in a factory in California, codes of business conduct, and handling of an investigation into the safety of its driver assistance technology.

Could we have seen it coming?

Different ratings agencies base their assessments on a vast array of metrics and evidence points, and one of the fundamental primary sources are a company’s own disclosures. Self-reported data won’t always tell the full story on bad news, but silence can be as revealing as noise.

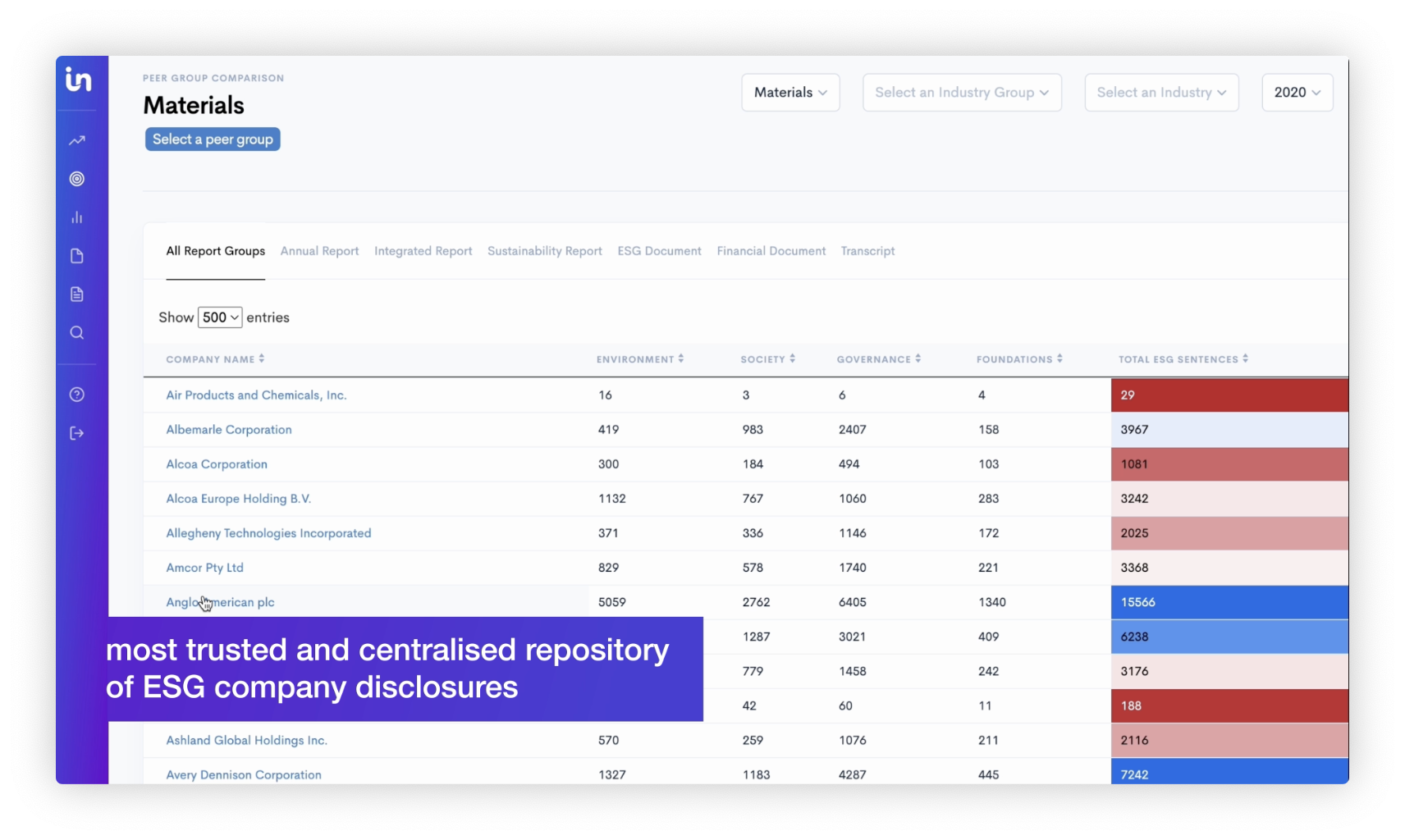

Let’s take a look at the data on Tesla’s disclosures compared to its industry group peers using our ESG Research Tool.

- Insig AI’s ESG Research Tool contains a library of thousands of corporate reports and ESG-relevant documents, 2015 to freshly published.

- AI-enabled search tools instantly surface granular ESG trends and company level disclosure metrics and link from sentence to source.

- A simple platform designed to arm investors with new powers in transparency and due diligence to form evidence-based decisions.

It’s all about the peer group

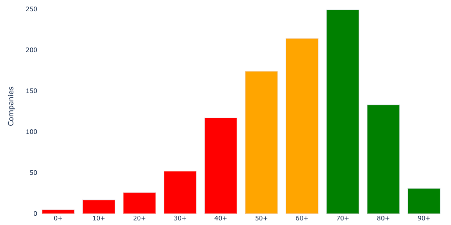

S&P makes the point that Tesla falls behind its group at a GICS industry group level, among its Automobiles and Components peers. Taking a glance at the overall disclosure levels for the group* Tesla ranks third behind Ford Motor Company and General Motors.

*sample group of a range of US large cap companies as well as smaller ones, not intended to replicate the full S&P500 index

This indicates Tesla’s overall disclosures are strong, but S&P pulled them up on the details so let’s start to break the E, S and G down.

Mind the gaps

Using a keyword/phrase search to get a high-level view on trends in disclosure, we analysed 28 different report types published by the three companies over 2018-2022.

On the social side of things, Tesla appears to lag on some material issues for the industry such as human rights and an inclusive workforce.

Running a simple search for key governance keywords tells a similar story on references to corruption and cyber, while Tesla’s volume of disclosure around business conduct is much higher than the others.

While quantity of references doesn’t tell the full story, this high-level snapshot points us to do a little further digging into the details.

A climate change mission without a low-carbon strategy?

Tesla’s 2021 body of publicly disclosed documents contained 481 sentences around the theme of climate change (as assessed by Insig’s expert-trained AI models). By comparison, General Motors totalled 450 and Ford Motor Company 374. So we can take from this evidence that Tesla are currently leading on the talk around the issue generally.

But taking it one level down to keywords relating to high quality disclosure in line with the international reporting frameworks, there’s quite a different story. From the search conducted below over the companies’ body of disclosure over the past 4 years, there’s a stark difference between Tesla and the leading industry peers.

Drilling down to the evidence base at report level, are they lacking the detail when it comes to a low carbon strategy as S&P punished them for? Taking General Motors and Ford as a benchmark, the document level comparison quickly reveals so.

In 2021, both General Motors and Ford set low carbon targets (disclosures shown on the left of each screenshot), with that of Tesla markedly absent, as shown on the right in both cases in their Sustainability Report, and similarly in their 2021 and 2022 10-Ks.

Relationship with the regulators?

S&P commented that Tesla’s handling of an investigation by the National Highway Transportation Safety Administration also weighed on its score. Tesla’s Q3 2021 earnings call transcript skims over the matter and the tone of voice during the Q&A is all around welcoming regulation and cooperation, as surfaced by searching for keyword ‘regulatory’ across the machine-readable version of the document;

Q: What is your view on the tightening regulatory environment for FSD [Full Self-Driving], the investigation and broad data request by NHTSA?

A: There are ongoing regulatory inquiries taking place all the time and especially on the subjects like FSD that are at the cutting edge of technology development. During these investigations, my team, myself are always cooperative as much as possible.

Legal issues and litigation cases?

Tesla’s 2022 10-K, released at the end of March, is the main source of S&P’s evidence for concern around legal proceedings involving environmental fines and workforce litigations.

The filing clearly contains disclosures on fines paid to the Environmental Protection Agency for Clean Air Act violations, as well as investigations around waste handling in California, and fines paid in Germany for non-compliance with battery take back obligations. The 2022 10-K also contains disclosures relating to litigation around racism, hostile work environment and pay equity claims.

In plain sight?

So, if S&P could surface enough evidence that Tesla isn’t being a good enough corporate citizen to outweigh its vision of low-carbon transport, why couldn’t everyone else? S&P will employ teams of researchers collecting and reading documents alongside external sources. While this is a mammoth task, the information (or lack of) when you look for it, is often in plain sight.

The main challenge for investors to do equivalent research on disclosures is the sheer volume and variety of reports, which are painful to collect and scrutinize, making it difficult to surface warning signals. Meanwhile, the challenge for ratings agencies is that many only rebalance once a year so they’re also vulnerable to criticism of backward-looking assessments.

Whatever next?

So, it turns out that the ESG appraisal of a business is full of paradox and riddled with trade-offs and one number doesn’t tell the whole picture, or necessarily do what you expect it to. If this comes as a shock, it’s probably time to take ratings with an even bigger dose of salt and get hands on the evidence that accumulates into these sorts of ratings decisions.

What if you could combine the research capabilities of a team of deep diving ESG analysts, with an up-to-date, centralised repository of disclosure evidence that could be quickly searched? You’d be able to identify early patterns and warning signals that may help anticipate the next shift in the ‘EGS world according to S&P’.

This is why we believe our ESG Research Tool is such a game-changer for the industry, in arming investors with independent research super-powers so they don’t have to wait for the next ratings re-balance.

With greater autonomy comes the ability to define what matters; to judge, for example, whether poor compliance might signal systematic flaws in governance that could escalate into more critical risks, or whether the vision of positive global impact outweighs that.

27 January 2025

Finding reporting gaps: essential to ESG analysis and a weakness of LLMs

27 January 2025

The relentless surge of AI technology: are you falling behind?

27 June 2024

TDI Global reveals 59% of world’s largest companies are failing to meet basic reporting expectations, while the UK takes a clear lead

8 April 2024

Using AI to help financial regulators detect greenwashing. Presentation with ImpactScope at World AI Cannes Festival 2024

31 January 2024

Harnessing specialised large language models for corporate sustainability reporting

20 November 2023

Transparency & Disclosure Index reveals stark differences in reporting patterns across UK's largest companies

4 April 2023

Only 5% of FTSE100 have credible climate transitions plans according to EY: Insig AI's response

9 March 2023

Generative AI: The game-changing access to advanced technology

20 January 2023

Building a best practice ESG risk scoring system for private entities

8 November 2022

UK Financial Services Sector Gender Pay Gap ‘Walk vs Talk’ Report

7 October 2022

ESG is creating data nightmare for companies and investors alike

19 August 2022

Video: ESG disclosures have exploded. But we’ve got you covered with everything at your fingertips.

19 August 2022

Video: Don’t spend hundreds of hours drowning in reports. Get everything at your fingertips.

7 August 2022

Household names from Tesco to Ocado failing to give enough information about how they will survive in a 'greener' economy

5 July 2022

Balancing the net-zero ambition with the greenwashing tightrope

30 June 2022

How important is ESG to the global financial institutions, and global business and are we ready?

14 June 2022

Tesla kicked out of S&P’s ESG Index: What just happened

24 May 2022

SEC issues first 'greenwashing' fine to an investment adviser

18 May 2022

Sustainable companies are more expensive, says study

12 May 2022

Using AI to discern if enterprises are walking the talk on ESG

20 April 2022

What does the future of ESG disclosure look like?

14 April 2022

What exactly is governance?

29 March 2022

TCFD: Which FTSE companies are ready for the 6th of April…and which are not?

23 March 2022

European machine readable company filings: a data scientist's dream

14 March 2022

Is now the time for schemes to consider natural capital?

8 March 2022

Women in finance - experts reflect on their experiences

10 January 2022

ESG scoring systems are giving way to intelligent analysis of disclosures

10 January 2022

Machine learning can help investors tackle fast fashion ESG issues

31 December 2021

Technology: For explainable AI, look in the white box

19 October 2021

Does motivation matter when the outcome is positive?

15 July 2021

Seeing the wood for the trees with the help of AI

4 April 2021

Some observations from implementing Named Entity Recognition algorithms in the real world

22 March 2021

AI offers unparalleled insights to the asset management industry

4 March 2021

Why is impactful data hard to find and what it means for the future?

4 January 2021

Bad data in official places: the UK’s National Storage Mechanism

4 January 2021

How to get more value from data: actionable solutions to common problems

14 July 2020