AI offers unparalleled insights to the asset management industry

Back to insights

Steve Cracknell, CPO

22 March 2021

When I co-founded Insig AI three years ago with my colleague Warren Pearson, we did so with a purpose to transform the asset management industry through AI and machine learning. This mission was based on multiple conversations we had with industry leaders where it became apparent to us that while many wanted to get the benefits of machine learning and AI, they simply did not know how to go about it.

Through companies like Citadel and BlackRock, we have seen just how successful machine learning and AI can be. Few in the industry, however, have their resources – to spend big and build teams who can create bespoke in-house solutions – and the challenge for them becomes how to keep up. This is where Insig AI’s suite of “out of the box” products come in. Our solutions allow investment professionals to see, interact, and experience their data in a way they never have before.

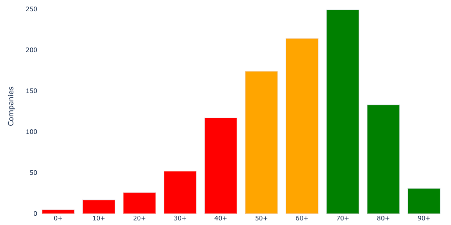

A core way in which we do this is through data visualisation. When we take a client’s data and apply our machine learning and AI tools to it, we are giving them the ability to interpret it through multiple lenses in a fraction of the time traditional tools would take. The success our clients are enjoying shows just how beneficial these solutions are. One client’s fund has so far outperformed by 30 percentage points, while another has experienced a 25% reduction in operational costs.

It’s important to note that these results are not reached by machine learning and AI alone, but rather augmenting the portfolio managers’ decision-making ability and judgement. The tools generate insights that may otherwise have gone unseen. Ultimately, however, investment decisions continue to remain with the portfolio manager. One of the major benefits AI and machine learning products gives to asset managers is speed in processing and investigating data. When once testing a hypothesis would once have taken five days to investigate can now be done in a matter of minutes.

As many asset managers know, their first instincts on an investment can often be far from the mark. Machine learning and AI products expedite this discovery process, so when they are wrong – they know it fast. This allows the user to move on to their next hypothesis rapidly. The success here lies in being able to investigate multiple theories at once, in order to find and validate the right path forward. During the discovery process, we also know that when weighing a decision, it is equally important to know the data and decision-making behind it. Therefore transparency is a core pillar of our company and our products are not “black boxes” – you can drill down every step of the way.

As new trends and industry sentiments emerge the ability to be flexible will be as important as ever. As the global asset management spend on AI is set to reach $8.3bn in the next five years, technology will continue to play an ever-increasing importance.

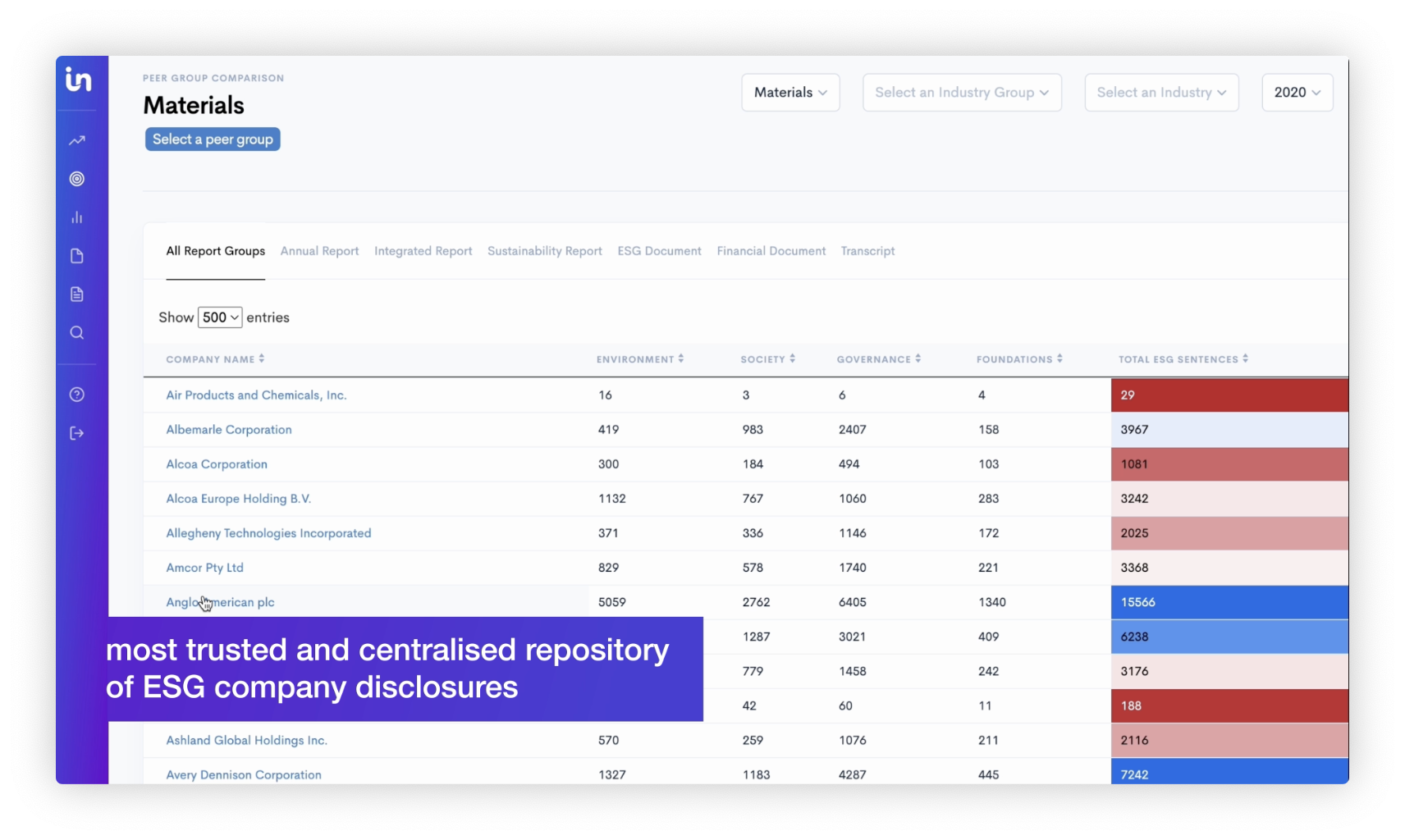

To this end, we are already developing a product called Insig ESG, set to launch in the third quarter of this year, which will develop our clients ESG strategy and execution. While our future products pipeline will look to continue to enhance the ability to mitigate risk, reduce costs, deliver better returns, and deliver products and services more efficiently. The transformative ability of AI and machine learning on Asset Management is no longer the domain of a few, and Insig AI is the perfect partner to help deliver it, now and in the future.

27 June 2024

TDI Global reveals 59% of world’s largest companies are failing to meet basic reporting expectations, while the UK takes a clear lead

8 April 2024

Using AI to help financial regulators detect greenwashing. Presentation with ImpactScope at World AI Cannes Festival 2024

31 January 2024

Harnessing specialised large language models for corporate sustainability reporting

20 November 2023

Transparency & Disclosure Index reveals stark differences in reporting patterns across UK's largest companies

4 April 2023

Only 5% of FTSE100 have credible climate transitions plans according to EY: Insig AI's response

9 March 2023

Generative AI: The game-changing access to advanced technology

20 January 2023

Building a best practice ESG risk scoring system for private entities

8 November 2022

UK Financial Services Sector Gender Pay Gap ‘Walk vs Talk’ Report

7 October 2022

ESG is creating data nightmare for companies and investors alike

19 August 2022

Video: ESG disclosures have exploded. But we’ve got you covered with everything at your fingertips.

19 August 2022

Video: Don’t spend hundreds of hours drowning in reports. Get everything at your fingertips.

7 August 2022

Household names from Tesco to Ocado failing to give enough information about how they will survive in a 'greener' economy

5 July 2022

Balancing the net-zero ambition with the greenwashing tightrope

30 June 2022

How important is ESG to the global financial institutions, and global business and are we ready?

14 June 2022

Tesla kicked out of S&P’s ESG Index: What just happened

24 May 2022

SEC issues first 'greenwashing' fine to an investment adviser

18 May 2022

Sustainable companies are more expensive, says study

12 May 2022

Using AI to discern if enterprises are walking the talk on ESG

20 April 2022

What does the future of ESG disclosure look like?

14 April 2022

What exactly is governance?

29 March 2022

TCFD: Which FTSE companies are ready for the 6th of April…and which are not?

23 March 2022

European machine readable company filings: a data scientist's dream

14 March 2022

Is now the time for schemes to consider natural capital?

8 March 2022

Women in finance - experts reflect on their experiences

10 January 2022

ESG scoring systems are giving way to intelligent analysis of disclosures

10 January 2022

Machine learning can help investors tackle fast fashion ESG issues

31 December 2021

Technology: For explainable AI, look in the white box

19 October 2021

Does motivation matter when the outcome is positive?

15 July 2021

Seeing the wood for the trees with the help of AI

4 April 2021

Some observations from implementing Named Entity Recognition algorithms in the real world

22 March 2021

AI offers unparalleled insights to the asset management industry

4 March 2021

Why is impactful data hard to find and what it means for the future?

4 January 2021

Bad data in official places: the UK’s National Storage Mechanism

4 January 2021

How to get more value from data: actionable solutions to common problems

14 July 2020