Building a best practice ESG risk scoring system for private entities

Back to insights

Diana Rose, Head of ESG Research & Richard Sansbury, Head of ESG Operations

20 January 2023

The Brief

- Build a proprietary ESG risk scoring model for debt instruments for a portfolio of private entities.

- Combine ESG scores from a major ratings agency with alternative ESG data available for private entities not covered by the ratings agency.

- Support the build of an investment manager’s portfolio that beats the benchmark index’s ESG score while delivering competitive returns.

- Apply data science, AI and optimisation techniques to construct efficient portfolios.

- Deliver a market-leading solution, the first of its kind, fully auditable that attracts capital.

Approach to ESG risk

Every organisation is exposed to ESG risk by the nature and scale of their operations. Companies can mitigate this risk to avoid material risk. To assess if ESG risk has been mitigated sufficiently, there are two measurable risk components: Exposure and Management.

- ESG Exposure is fundamentally a factor of the industry and region in which the company operates, and is based on a system of materiality.

- ESG Management is company-specific and assessed through analysing a company’s risk awareness and mitigation, gathered primarily from evidence published in reports.

- These two components can be combined to reflect proportionality and produce a single ESG Risk Score that can be integrated into investment decision-making.

When data is lacking

When modelling company risk, ESG Exposure can to a reasonable degree be estimated by its industry average as it is a factor of operations, size and location. So, in cases where a company is not covered by a ratings agency, a score can be estimated as the best available technique. This approach is less reliable for assessing ESG Management, where companies diverge greatly in their approaches to addressing risk exposure.

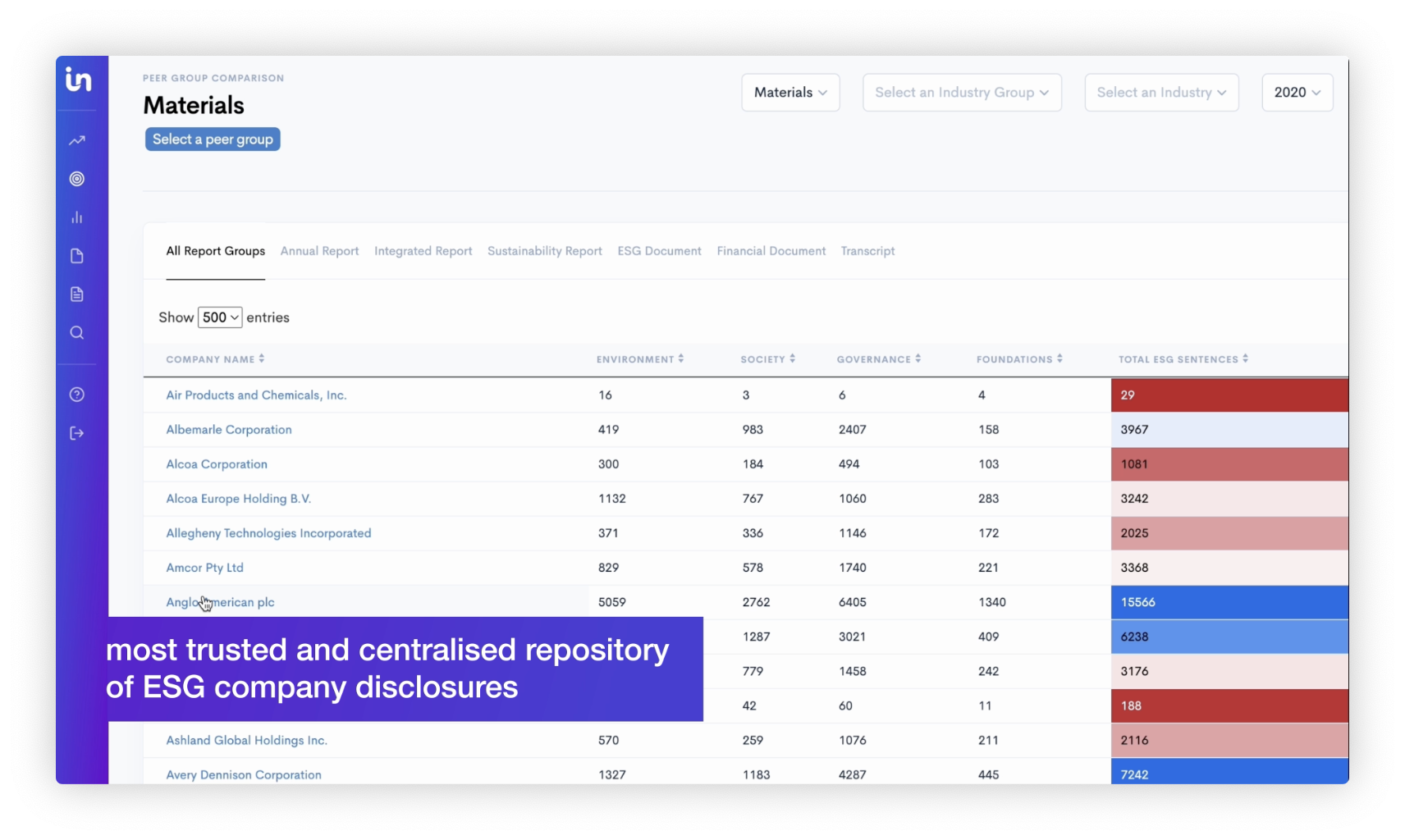

Therefore, Insig AI integrated alternative sources of ESG data to assess ESG Management. Our data compliments the ESG ratings agency score and enhances the industry average scores for companies not covered by the ratings agency.

Part 1: Building an ESG Exposure scoring model

Re-build an ESG Exposure scoring model from scratch in line with client’s risk methodology.

- Disaggregate, re-build and re-weight elements of the ESG ratings agency data into a new scoring model to give the manager greater control over risk factors at a more granular level.

- Forensic entity mapping between data providers which use different identifiers and formats, including MSCI, Capital IQ and S&P to improve data reliability.

- Implement ESG risk factors specific to debt instruments such as loan maturity in line with investment manager’s proprietary methodology.

Part 2: Developing a new ESG Management score

Create an innovative ESG Management scoring methodology based on company disclosures that is appropriate for entities not covered by the ESG ratings agency.

- Collect, tag and validate all Annual Reports and ESG/Sustainability Reports published on portfolio and benchmark fund companies’ websites since 2019.

- Convert all documents (mostly in .pdf format) to machine readable text. Split text into sentences, tag and store in a cloud-based database.

- Apply a ESG issue-specific Natural Language Processing (NLP) models over the text. NLP models are expert-trained to assess sentences for their relevance to ESG risk issues such as climate change, water, human rights and workforce.

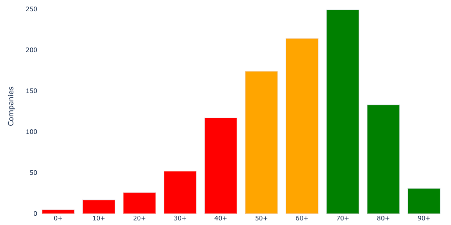

- NLP models generate an ESG Disclosure metric based on volume of relevant sentences in the company’s disclosures.

- This ESG Disclosure metric is mapped and weighted with the ESG ratings agency data to produce the combined ESG Management score.

Part 3: Generating the final ESG Risk Score

Combine ESG Exposure and ESG Management into a final ESG Risk Score for the portfolio manager to assess in a web-based application.

- ESG Exposure and ESG Management scores combine into a single, company specific ESG Risk score.

- The scoring model is first developed with the investment manager, then coded into Python and finally delivered in a web-based application.

- Design a graphic front end that allows the investment manager to compare the portfolio against the benchmark and adjust parameters.

- The code, methodology and application are fully transparent and auditable and by third

- ESG Risk score is integrated with fundamental investment data in Insig AI’s machine-learning portfolio optimisation tool.

Outcomes

An innovative fund is launched which aims to build integrated ESG portfolios, establish the investment manager as a leader in ESG investment and successfully attract capital to sustainable methodologies. The model can be applied to the clients’ other debt and equity products.

Get in touch to find out if our approach could be applied to your credit or debt portfolio, and accelerate your ESG investing journey: info@insg.ai

27 June 2024

TDI Global reveals 59% of world’s largest companies are failing to meet basic reporting expectations, while the UK takes a clear lead

8 April 2024

Using AI to help financial regulators detect greenwashing. Presentation with ImpactScope at World AI Cannes Festival 2024

31 January 2024

Harnessing specialised large language models for corporate sustainability reporting

20 November 2023

Transparency & Disclosure Index reveals stark differences in reporting patterns across UK's largest companies

4 April 2023

Only 5% of FTSE100 have credible climate transitions plans according to EY: Insig AI's response

9 March 2023

Generative AI: The game-changing access to advanced technology

20 January 2023

Building a best practice ESG risk scoring system for private entities

8 November 2022

UK Financial Services Sector Gender Pay Gap ‘Walk vs Talk’ Report

7 October 2022

ESG is creating data nightmare for companies and investors alike

19 August 2022

Video: ESG disclosures have exploded. But we’ve got you covered with everything at your fingertips.

19 August 2022

Video: Don’t spend hundreds of hours drowning in reports. Get everything at your fingertips.

7 August 2022

Household names from Tesco to Ocado failing to give enough information about how they will survive in a 'greener' economy

5 July 2022

Balancing the net-zero ambition with the greenwashing tightrope

30 June 2022

How important is ESG to the global financial institutions, and global business and are we ready?

14 June 2022

Tesla kicked out of S&P’s ESG Index: What just happened

24 May 2022

SEC issues first 'greenwashing' fine to an investment adviser

18 May 2022

Sustainable companies are more expensive, says study

12 May 2022

Using AI to discern if enterprises are walking the talk on ESG

20 April 2022

What does the future of ESG disclosure look like?

14 April 2022

What exactly is governance?

29 March 2022

TCFD: Which FTSE companies are ready for the 6th of April…and which are not?

23 March 2022

European machine readable company filings: a data scientist's dream

14 March 2022

Is now the time for schemes to consider natural capital?

8 March 2022

Women in finance - experts reflect on their experiences

10 January 2022

ESG scoring systems are giving way to intelligent analysis of disclosures

10 January 2022

Machine learning can help investors tackle fast fashion ESG issues

31 December 2021

Technology: For explainable AI, look in the white box

19 October 2021

Does motivation matter when the outcome is positive?

15 July 2021

Seeing the wood for the trees with the help of AI

4 April 2021

Some observations from implementing Named Entity Recognition algorithms in the real world

22 March 2021

AI offers unparalleled insights to the asset management industry

4 March 2021

Why is impactful data hard to find and what it means for the future?

4 January 2021

Bad data in official places: the UK’s National Storage Mechanism

4 January 2021

How to get more value from data: actionable solutions to common problems

14 July 2020